Bitcoin: “In the long term an alternative for the bank”

The bitcoin hype has not skipped the TU/e. Students too have invested their savings, hoping to take advantage of the popularity of cryptocurrency: "I thought about selling my bitcoins when the highest peak came in December 2017, but I doubted whether it was smart. Perhaps it would rise much further. Unfortunately that did not happen -yet”, says Adonai Rodrigues Da Cruz, PhD student at Semiconductor Physics.

Profit is certainly not the only goal. All students are particularly interested in the underlying blockchain technology that offers many opportunities for the future. In addition to bitcoins, Margarita Kuzina also invested in other cryptocurrencies: ethereum and blackmoon. "As an Industrial Design student I am interested in new technologies and blockchain is a good example of this. Cryptocurrency such as bitcoin certainly has potential as an alternative to the bank, but it still needs time, it is still in the development phase.”

Increase in interest

B&R Beurs Eindhoven, the student investment association of the TU/e sees an increase in interest on the campus for their association after the bitcoin hype. Chairman Joep Peeters: "Partly because of the hype surrounding bitcoin, we see that a broader public has become interested in investing." How could it become such a hype? Treasurer Lyndon Hofwijks thinks it has to do with the confidence in the banks that declined during the financial crisis and the possible alternative that bitcoin offers for those institutions. But the success stories also play a role: "people who bought bitcoins for a few hundred euros and made a lot of profit also make others dream. The curiosity is triggered. Then more and more people buy bitcoins, the demand increases, the coin becomes more valuable and the bubble is born."

Trust in bitcoin

Is bitcoin a monetary revolution or just a bubble? The future will tell, but the students see great potential in the cryptocurrency. Aref Moradi, master student Data Science: "I invested in bitcoin, neo and ethereum. I'm not sure if the hype around the bitcoin is over, but in the long term governments may also validate and use bitcoins. When that happens, many more people will get confidence in bitcoin and use it. Then it can really become mainstream." Kuzina finds the idea of direct trade without the intervention of a bank attractive: "I don’t dare to invest all my savings on it yet. Perhaps that will change if it becomes more stable. It certainly has potential as an alternative to the bank, but it still needs time, it is still in the development phase."

Bitcoin is a peer-to-peer payment system. The money goes directly from buyer to seller, without the intervention of a bank. A decentralized digital currency.

Money is really just an accounting system to keep track of who owes what to whom. Banks are in between to make sure the money is real and that it is managed neatly. Governments produce the money. This system has been operating like this for centuries.

Bitcoin is also an accounting system, but because it is set up as a consensus system, the bank is no longer needed. This saves costs and inefficiencies, as well as potential corruption. The bitcoin ledger is checked on thousands of computers instead of at one central point. Manipulation of one point to manipulate the entire system (such as when hacking banks) is no longer possible. The identity of the bitcoin wallet and thus the user is encrypted. So you don’t know who is spending the money. But you do know that every bitcoin has a history and you can see exactly where it has been.

Main features of bitcoin

- Blockchain for proof of work

- Peer-to-peer system

- Solving cryptographic puzzles to earn coins

- Time stamp for new coins

- Doesn’t need a trusted third party

- Consensus needed before moving to the next block in the chain

The attraction of cryptocurrencies

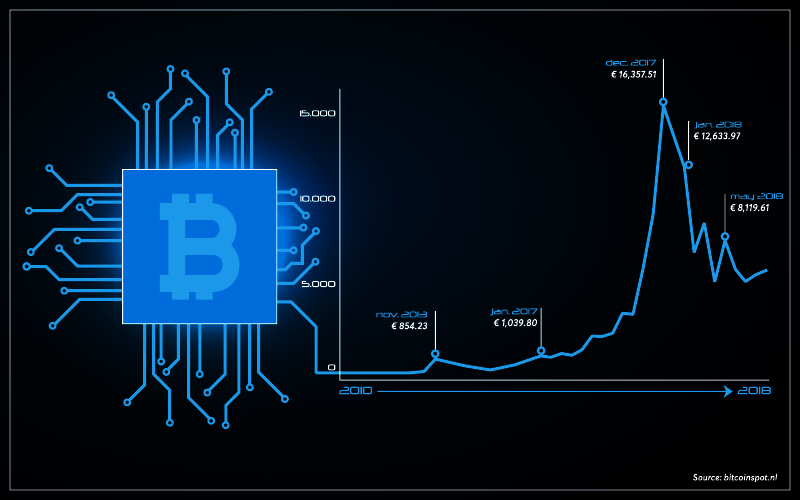

Initially, computer scientists and coding enthusiasts were interested in bitcoin because of the interesting blockchain technology behind it. Due to the hype of 2017 (with the highest listing of €16,357.51 per bitcoin in December), there are now many interested parties.

The bitcoin (and other cryptocurrencies) may be more than just an interesting investment. It gives more people access to a form of an account, allows more people to enter the trade market and offers support to the informal economy, which is particularly prevalent in third world countries.

But it also offers an opportunity to exchange money easily and export it from rather closed countries. Moradi and Da Cruz confirm this. Moradi: "I hope to make a profit with my investment, but there are more interesting advantages to investing in bitcoins. In Iran, where I come from, it is rather difficult to exchange currencies or send (large) sums of money abroad. Bitcoin offers a solution for this. I know that there are many students who use bitcoin to exchange their money for dollars." Da Cruz also mentions this argument: "In Venezuela it has been hard to get products due to shortages during the financial crisis. With the bitcoin it suddenly became possible to change money and buy things outside of Venezuela. But unfortunately, the government got the hang of it and now that is no longer possible."

Cypherphunks started with cryptocurrencies. They were concerned about the privacy (of expenses) in the traditional system and wanted an anonymous currency. The main thing behind cryptocurrency is not the money, but the blockchain technology. It offers opportunities that go far beyond just an alternative to the euro or the dollar. Blockchain technology can change the whole system by removing the central point and replacing it with chain control, which is much less easy to manipulate. Winston Arts, responsible for external relations at B&R, also has some cryptocurrencies. "I enjoy to look at the possibilities of the technology and possible capital opportunities that it could create for starting companies.”

Blockchain technology

Bitcoin is based on blockchain technology. This involves a network of computers (nodes) that work with chains and control points. The blockchain technology is unique because it allows transactions without the use of a third party such as a bank. The falsification of data cannot happen by hacking one central point.

Bitcoin uses the Hashcash Proof of Work (PoW) system to generate new blocks in the blockchain. The PoW system works with an item that is difficult to produce but is easy to validate. Each block contains the hash of the previous block. If there would then be tampering with a previously approved block from the chain, this is noticed because the hash no longer connects to the block before that. In other words: if you want to change a block at the beginning, all blocks after that must then also be changed, or be found again, because otherwise the total branching is no longer correct.

Smart contract

Da Cruz has bitcoins, ethereum and IOTA. "I chose bitcoins because they are more mainstream and the other two because I find the underlying technology interesting. If it yields some profit, that’s great but I am more interested in the potential of the platforms and the blockchain technology. I find ethereum the most interesting because of the smart contract application."

Kuzina would like to see blockchain technology reflected in education: "As a designer, it is interesting to look at the application possibilities of blockchain, in particular smart contracts. It is still fairly abstract and unclear to me where I can apply the blockchain technology in the future as an industrial designer. Perhaps in medical technology or information exchange. That is why I would like to stay informed, but I think it is unfortunately still too new to teach it."

Smart contract is an application of blockchain that offers the technology a much broader perspective. With a smart contract you don’t need to have a third party in a contract process anymore. The rules and conditions are in fact programmed in the contract itself. These codes ensure that such a smart contract can maintain itself. This can be applied to all kinds of contracts, such as mortgages, inheritances, insurances, music rights, etc.

It is sometimes argued that blockchain technology can not be hacked. That has to be nuanced, according to Kuzina: “Unhackable? I think people might be so enthusiastic about it that they simply don’t see the leaks. I do not believe that there is something that cannot be hacked. I myself may not be able to hack it, but there is probably someone who can. Attentiveness is still important.”

Buy bitcoins or mine them yourself

If you would like to have bitcoins or other cryptocurrencies, you can buy or mine them. Being rewarded with a bitcoin is a side issue in mining. The primary task is to verify and validate transactions. Though many miners compete to be the first to find the next block of the chain. The person who is the fastest, is rewarded with a bitcoin. That mining happens by solving very complex calculations.

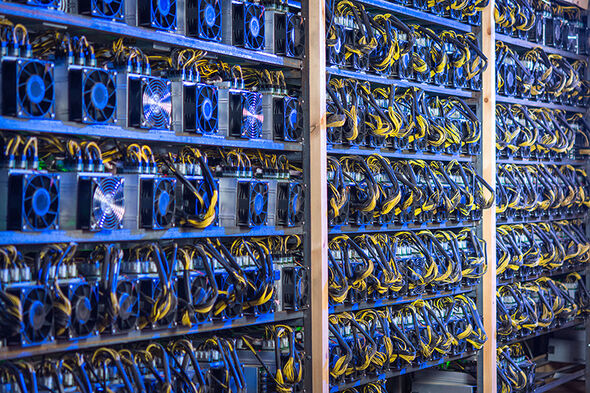

After the hype around the bitcoin mining became much more difficult and costly. To be able to mine now, you need a lot of computing power. The necessary video cards have risen sharply in price and keeping the computers running is also not free of course. That is why this is outsourced to China and Iran a lot, where energy is cheaper. There are huge mining factories in those countries. Moradi confirms that: "I myself have bought my bitcoins, but mining here in the Netherlands is becoming less attractive. There are even miners who have computers in Iran or China who then rent them to people there to mine for them. They then take a share in the profits."

Da Cruz also mined himself when he was still living in Brazil. "I mined ethereum for a while but stopped when I came to the Netherlands for my PhD. Energy became increasingly expensive in Brazil. I know people who mined in Brazil and for that reason moved their business to Paraguay. But the largest 'mining factories' are in China."

Hofwijks also puts a critical note to the mining. “The environment suffers from the high energy consumption of all mining warehouses. It is interesting to look at other forms that use a different protocol than solving calculations on computers. The bitcoin system invites you to have as many video cards as possible. You need a lot of money to start mining. Therefore, it seems to me that in the longer term there will be a central power: the people with the most computing power will get the most power. That is undesirable given how bitcoin was ever intended.”

Starting with bitcoin

Anyone with a device with internet access can use bitcoin. You create a free online wallet and can then buy bitcoins that will be stored in it. If you want to pay in stores that accept bitcoins, you can scan a QR code, after which the bitcoins will be debited from your wallet. There are different types of wallets for small, medium and large investments.

Warning: investing involves risks. You have to be well aware of this before you start investing in (for example) bitcoins.

Discussion