Emergency funds give startups some breathing space

Despite some flexible measures from the government for companies, almost all businesses will still face a setback as a result of the crisis. The impact of this pandemic on startups and scale-ups, many of which often depend on investors, could be quite significant. What if an investor pulls out? Will those small businesses with their innovative products and services go bankrupt? To prevent this from happening, the government has set up the Corona Bridging Loan (COL). But a regional fund has been set up as well.

“To stand still is to move backwards. We need to ensure that the development of our product won’t come to a halt,” says a combative Alex Pap, TU/e alumnus and CEO of XYZ Dynamics, a startup that produces electrically-driven axles for delivery vans. His company converts existing delivery vans into hybrids, which allows them to enter low emission zones. An electrically driven axle also makes driving significantly more cost-efficient.

“We had almost secured a substantial investment, but it is now on hold,” Pap says. “That is why we too had to postpone some investments, and reluctantly had to make spending cuts in other areas. We also immediately sat down with our partners. They were very sympathetic and still appreciate the value of our product. But these companies are also faced with a loss of turnover. That is why we submitted several applications to emergency funds, such as Bright Move, an initiative where the TU/e also takes part in.” That application has been approved by now, Pap says.

Between two stools

Apart from the national Corona Bridging Loan (COL), which is locally coordinated by the Brabant Development Agency (BOM), businesses, knowledge institutions and local authorities in the Brainport region have set up their ow regional fund as well. This fund is intended to support entrepreneurs who are in danger of falling between two stools when applying for a national loan. The sums of the loans involved range between 15 and 30 thousand euros.

“These regional funds allocated by Bright Move and those allocated by the national government are supplementary,” says Robert Al, who is Head Business Development at TU/e’s Innovation Lab and director of Bright Move. The financial support needs to prevent innovation in the region from suffering a serious setback in the coming years. Al: “It is meant for small businesses that don’t qualify for government support yet. In addition, we can respond faster, which means startups won’t have to wait that long for support. That’s of crucial importance to businesses like these.”

The regional funds allocated by Bright Move and those allocated by the national government are supplementary

The latter factor was very important to XYZ Dynamics as well. Pap: “The loan gives us some breathing space, but it’s not enough if we want to continue to develop. That is why we are still actively trying to secure other forms of financing, until those investments that are currently on hold will proceed as planned.”

Long-term research

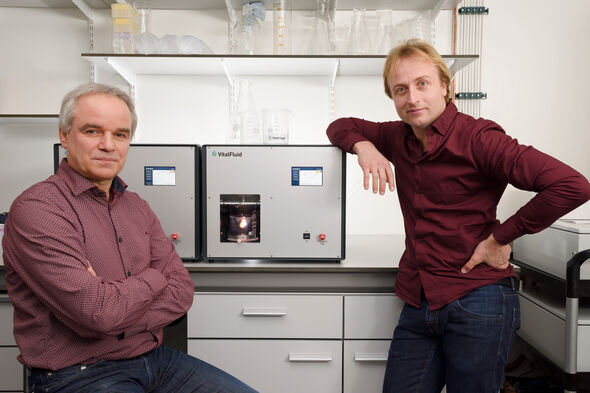

VitalFluid is another startup that sees its income drop as a result of the corona crisis. This company activates water with plasma. After the activation process, the water possesses unique disinfecting properties for a short period of time. It is currently mostly used in the agricultural sector, for example for seed disinfection to keep plants free of diseases. The company already has several clients and was just about to sign an investment contract.

“Until that investor called the notary on the day they were supposed to sign to inform us that they didn’t want to go through with it after all because of the corona crisis,” says Paul Leenders, who cofounded the company in 2014 with Polo van Ooij, researcher at TU/e’s department of Electrical Engineering. VitalFluid currently has a staff of nine people, Leenders included, and he says he’ll do his utmost best to keep everyone on board.

Leenders has by now applied for a COL at the BOM. “For our clients, priority now lies with securing production. Our products are used primarily for long-term development. Those projects are often postponed now,” Leenders says. “Our own research into the development of new products with this technology was delayed due to the lockdown as well. It’s simply more difficult to do research from a distance,” he explains.

Sustainable business model

“The loans we furnish now are meant as a bridge towards a break-even situation, which the entrepreneur needs to demonstrate once an enterprise becomes profitable again, or when it starts a new financing round,” says Marc Jansen, manager Brabant Ventures at the BOM. The sums involved with the COL range between 50 thousand and 2 million euros. “When businesses apply, they need to be able to demonstrate that their business model was sustainable prior to the corona crisis, and that their revenue loss is a result of the outbreak of the virus.”

The BOM has received about 130 requests for a loan at this point, with a total sum of over 500 million euros. The Corona bridging loan consists of three types of loans, with different sums and different ways of repaying. This depends on the size of the loan. Some loans are paid back after three years when the co-investor converts its interest into company stocks, while other loans have to be paid back within a few years. “When we receive an application, we also try to determine whether a business will be able to pay back the loan within the set timeframe,” Jansen says. “That is why the prospect of break-even or a new investment round is so important.”

When we receive an application, we also try to determine whether a business will be able to pay back the loan within the set timeframe

Entrepreneurs Pap and Leenders aren’t that worried about paying back their loans, both the national and the regional ones. They expect that a new investment round will take place within the next year. Jansen also thinks investors will show an interest again. “It will be a bit more difficult in the coming period because a number of investment companies are cautious now. They focus first on their own wallet before they start to invest in new companies. I expect that the situation will improve after six to nine months.”

Creative and innovative

Leenders says it’s difficult to estimate at this point exactly how much delay the development of his company and of the new products will suffer as a result of the crisis. “But in the end, I think that we will be able to carry on as planned and implement our business plan and grow as a company.” Pap adopts the same positive attitude. “A crisis leads to creativity and innovation. Some companies will go bankrupt and innovation will disappear, but I’m sure that new companies and products will emerge as well.”

He maintains that same positive attitude when it comes to his own company, XYZ Dynamics. “Having to cut people’s hours is unfortunate, but we need to continuously anticipate the situation. We and our partners are still enthusiastic about our sustainable solution. That’s the most important thing.” He hopes the government sees that as well, and that it will issue loans to startups that contribute to the country’s sustainability. “After all, that’s the future.”

Discussion