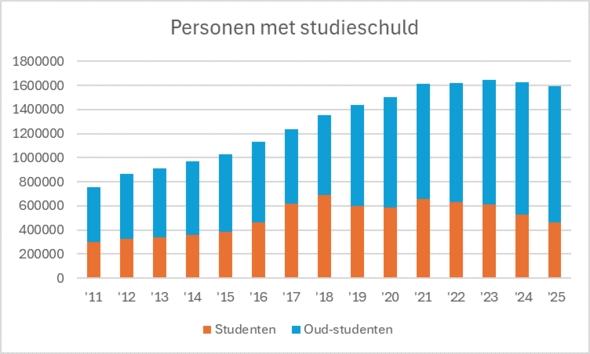

According to the latest figures from Statistics Netherlands (CBS), nearly 460,000 students are currently building up student debt. These are students who take out loans in addition to their basic grant and (potentially) supplementary grant.

That number is lower than in the peak year of 2021, when 657,000 students in secondary vocational education (mbo), universities of applied sciences (hbo), and research universities (wo) had student debt. The number of former students with debt, however, continues to grow: it now stands at 1.1 million.

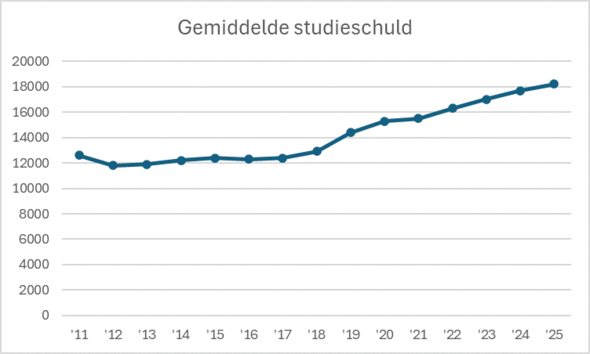

The average student debt also continues to rise, now exceeding 18,000 euros. The sharp increase did not occur immediately in 2015 when the new loan system was introduced, because the basic grant was only abolished for new students. It therefore took some time before the consequences became visible.

In September 2023, the basic grant was reintroduced. Its effects will also become more apparent in the coming years.

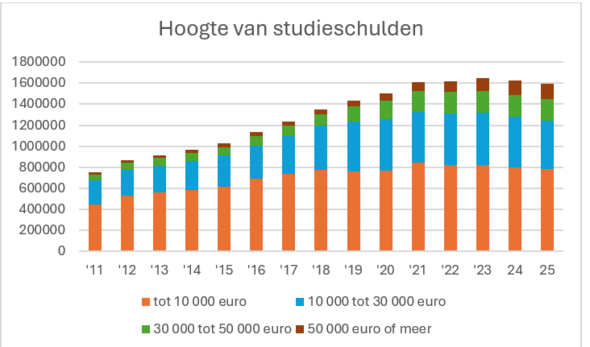

It is a positive development that fewer students need to borrow, says Sarah Evink, chair of the Dutch National Student Association (ISO). But she also believes the figures show that inequality among students is increasing, which she finds troubling. “It is distressing that so many people have student debt above 50,000 euros.” She fears that high debts may discourage young people from pursuing further studies.

Students can spread their repayments over 35 years, plus an additional five years during which they may temporarily pause repayments if desired. They pay according to their income: with a low income, the monthly repayment is capped. After 35 years, any remaining debt is written off. For years the interest rate stood at zero percent, but it has since risen.

Given the relatively favorable terms, some students may choose to borrow the maximum amount and use the money later when purchasing a house. In that case, they can take out a smaller mortgage from the bank. How many students actually do this is unknown.

Most of the debate, however, revolves around the opposite effect: because their high student debts count when applying for a mortgage, students often struggle to buy a house. The government nonetheless allows student debts to be hidden during the home-buying process, despite calls from various organizations not to permit this.

This article was translated usingAI-assisted tools and reviewed by an editor.

Discussion